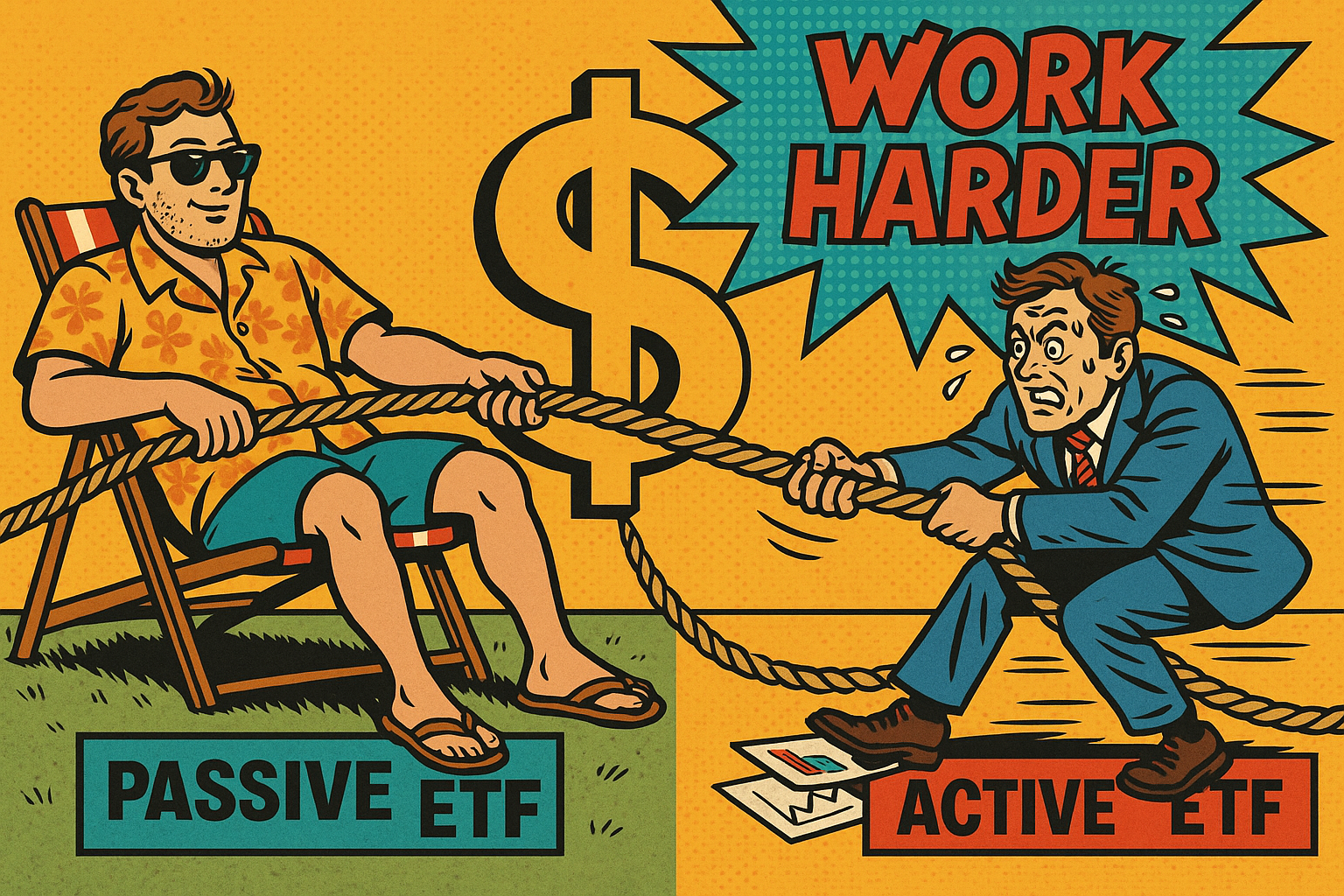

Active vs. Passive ETFs

What the heck are we talking about?

An ETF – a Exchange‑Traded Fund – is simply a basket of securities (stocks, bonds, whatever) that you can buy and sell like a share.

However, within ETFs you’ll see two main styles:

Passive ETFs: aim to track a benchmark/index.

Active ETFs: aim to beat a benchmark (or hit a specific goal) by manager decisions.

Whilst ~ 80%+ of total ETF assets on the ASX are in passive/index-tracking ETFs, it might be considering active ETFs as a Satellite within your lazy portfolio.

Passive in a nutshell

The fund picks the stocks (or bonds etc) according to a predetermined rule matching an index.

You get market returns (minus costs) — you’re riding the tide, not trying to out-swim it.

Usually lower fees because there’s no expensive stock-picking machine behind it.

Active in a nutshell

A fund manager (or team of fund managers) makes choices: on which securities to hold, when to buy, when to sell. They’re trying to beat the index.

More flexibility: can tilt to sectors, skip index companies, react to market changes.

But more cost, more risk (you might lose to the market, not just be okay with matching it).

Why should you care? (Yes – even as a “lazy” trader)

You’re busy (weekends raving, family time, dog walks etc). You don’t necessarily want portfolio management to be a second job. So understanding the trade-offs matters.

Cost matters: Fees eat returns. Passive = cheap; active = more expensive. (Small percentage points compound big time over years.)

Performance risk: Active could beat the market — but often doesn’t. Passive gives you “market” and moves with the tide.

Time & effort: Passive is simpler. Active may require you or your adviser to monitor more.

Fit with your style: If you’re a relaxed investor, passive works. If you’re curious, want niche plays or believe a manager can really add value, active might appeal.

The comparison — head-to-head

| Feature | Passive ETF | Active ETF |

|---|---|---|

| Objective | Track a benchmark or index (e.g. ASX200, S&P500) | Outperform a benchmark or achieve a specific goal |

| Management Style | Rules-based & automated – little human input | Manager-driven – human decisions on stock selection & timing |

| Fees | Low – often 0.03% to 0.20% p.a. | Higher – 0.60% to 1.00%+ p.a. |

| Risk | Market risk only – follows index movements | Market + manager risk – depends on decisions made |

| Performance | Matches market returns (minus fees) | Can outperform – but may underperform the benchmark |

| Transparency | Full holdings disclosed daily | May disclose less frequently or partially |

| Best For | Long-term, “set-and-forget” investors | Hands-on investors who believe in active skill or want thematic exposure |

What the data actually says

Many sources point out that a large portion of actively managed funds fail to beat their benchmarks.

On the ETF front: active ETFs are growing fast (more launches, lots of interest) though they still represent a smaller share compared to passives.

For most “normal” investors, passive investing has been very hard to beat consistently.